So you want to get started investing in the stock market, huh? That’s great – the stock market has historically been one of the best places for your money to grow. But where do you begin?

The stock market seems complicated, the jargon is like a foreign language, and you do not know which stocks to buy. Don’t worry, every expert investor was once a beginner. The key is to start with the basics, learn the fundamentals, sign up for valuable stock trading courses, and develop good habits. This guide will teach you the essential stock trading tips and tricks every new investor needs to know.

By the end, you’ll feel comfortable buying and selling stocks on your own. The stock market rewards patience and discipline. Follow these lessons and you’ll be well on your way to building wealth through the stock market.

In the fast-paced world of finance, mastering the art of expert trading is the key to maximizing your profits and achieving financial success. Whether you are a seasoned trader or just starting, this article will guide you through the essentials of expert trading and introduce you to the Expert Trading Course offered right here in Chennai by Traderz Arena. Let’s dive into the world of expert trading and uncover the strategies and insights that can make a significant difference in your trading journey.

Top 10 Stock Trading Tips for Beginner Investors

The stock market can seem overwhelming for beginners. But with some helpful tips, you’ll be trading stocks in no time.

Learn the Game:

Learn the Game:

Take some time to understand the basics of stock trading and how the market works. There are plenty of resources online and even some beginner-friendly books that can help you grasp the concepts.

Start with a Strategy:

Before diving in, develop a simple investment strategy. Decide if you want to focus on long-term investments, Intraday trading, or something in between. Holding a strategy will help you make smart decisions.

Take Baby Steps:

Start with small investments and gradually increase your exposure as you gain more confidence and experience. This allows you to learn without risking too much money upfront.

Diversify Your Portfolio:

Don’t put all your eggs in one basket. Diversify your investments across different stocks, sectors, or even asset classes. This can help mitigate risk and potentially increase your chances of overall success.

Avoid FOMO:

Fear of Missing Out (FOMO) can tempt you to jump into hot stocks without proper research. Avoid making impulsive decisions based on short-term trends or tips. Always do your due diligence.

Embrace Patient Investing:

Stock market success doesn’t happen overnight. Be patient and take a long-term approach. Giving your investments time to grow can often yield better results.

Follow Your Gut (to an extent):

While it’s essential to make informed decisions, don’t ignore your intuition completely. Sometimes your gut feeling can lead you towards opportunities that data alone can’t identify. Just make sure to have a solid reasoning behind your choices.

Keep Emotions at Bay:

Emotions can cloud judgment, especially when it comes to investing. Try to detach yourself from emotions like fear and greed. Stick to your strategy and don’t let short-term market swings dictate your decisions.

Learn from Mistakes:

Everyone makes mistakes, especially when starting out. Use them as learning opportunities. Review your trades, pinpoint any mistakes, and adapt your strategy accordingly.

Stay Curious and Keep Learning:

The stock market is ever-grown, so make a habit of staying informed. Read financial news, follow industry experts, learn the best mentorship programs for trading offered by many stock trading institutes, and continuously educate yourself. As you gain more knowledge, you will become more capable of making wise choices for investing.

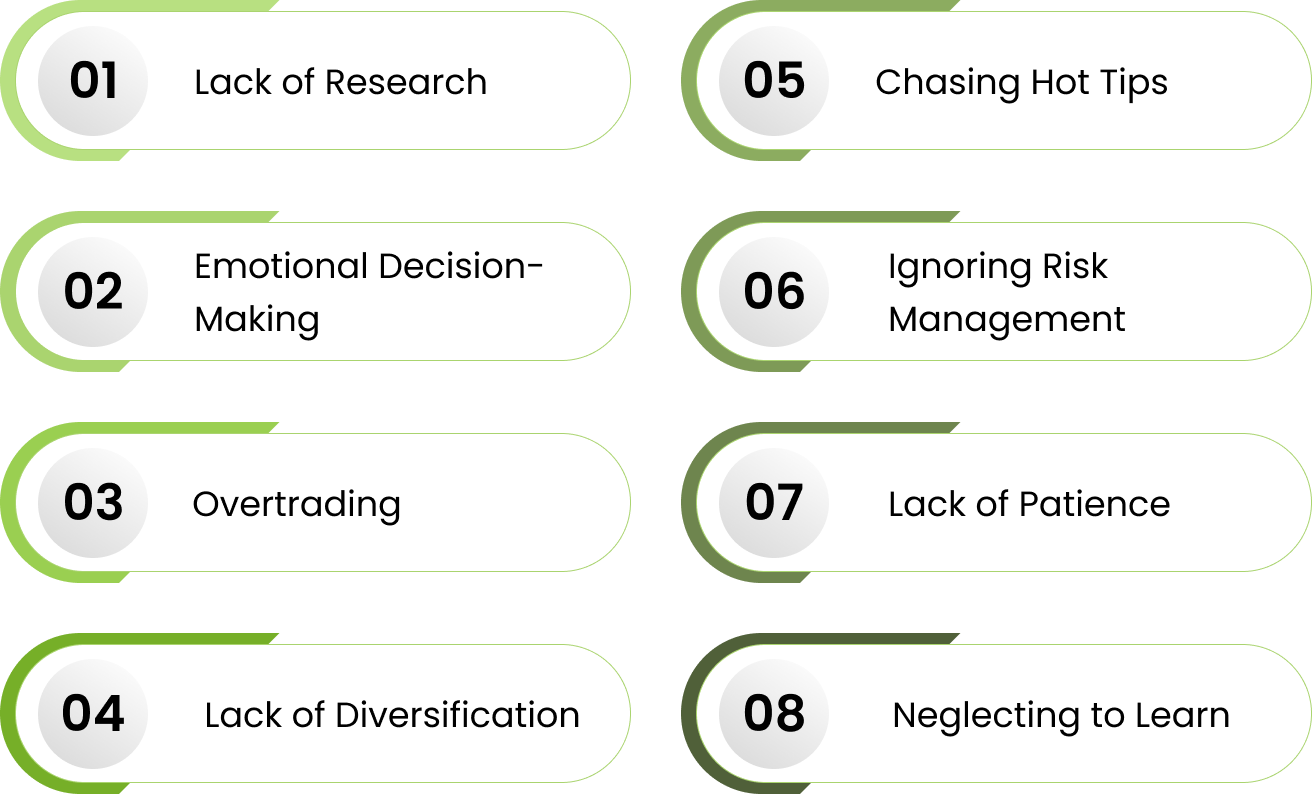

Typical Mistakes New Investors Make and How to Avoid Them

As a new investor, it is easy to make missteps that can cost you money. To avoid these common pitfalls and start building wealth, follow these tips:

Lack of Research:

One common mistake is not conducting thorough research before investing. It’s important to understand the company’s financials, market trends, and competitive landscape. To avoid this, spend time researching the stock, reading financial statements, analyzing market conditions, and staying updated on relevant news.

Emotional Decision-Making:

Making investment decisions based on emotions, such as fear or greed, can lead to poor outcomes. Avoid getting caught up in the short-term changes of the stock market. Instead, invest based on long-term fundamentals and a well-defined strategy.

Overtrading:

Some new investors buy and sell frequently, jumping in and out of positions without a simple strategy. This can cause excessive trading fees and potential losses. It’s important to have a disciplined approach and only make trades when there is a solid rationale behind them.

Lack of Diversification:

Failing to diversify the asset portfolio is another common mistake. By investing in a variety of stocks across different industries, regions, and asset classes, you can reduce the risk associated with any single investment. Diversification helps protect the portfolio from industry-specific or company-specific risks.

Chasing Hot Tips:

New investors often fall into the trap of following hot tips or rumors without proper analysis. It’s essential to rely on credible sources and conduct your own due diligence before making any investment decisions. Avoid making rash decisions based on rumors or hearsay.

Ignoring Risk Management:

Neglecting risk management is a mistake that can lead to significant losses. Before investing, define your risk tolerance and set stop-loss levels. Consider using methods like position sizing and setting a target risk-reward ratio to manage your investments effectively.

Lack of Patience:

Patience is a virtue in stock trading. New investors sometimes expect quick profits and get frustrated if they don’t see immediate results. Stock market investments require time to grow and compound. Avoid the temptation of chasing short-term gains and focus on your long-term investment goals.

Neglecting to Learn:

Stock trading is a skill that can be developed. Continuously educate yourself about investing principles, market trends, and investment strategies. Learning from experienced investors and studying successful investment approaches can help you make informed decisions.

Conclusion

You’ve got the basics down, now it’s time to practice. Open a brokerage account, fund it with some money you can afford to lose as you learn, and start making small trades to gain experience. Track your trades, wins, and losses, to see what’s working and not working. Don’t get emotional – stay detached and stick to your strategy.

There will be difficulties, but focus on the long game. With time and practice, you’ll get better at spotting opportunities, managing risk, and build wealth in the stock market. If you want to learn to trade, Traderz Arena provides training on how to consistently earn money. Learn from market experts and invest your course fee in live trading.

Stay hungry to keep learning, but also remember to start small, be patient, and enjoy the journey. You’ve got this! Now go out there and start investing in your future as a savvy stock trader.