Have you ever wondered how options trading works? Ever wanted to take advantage of the volatility in the market, but weren’t sure where to start? Well, you’ve come to the right place. This complete guide will walk you through everything you need to know to get started with options trading in India.

We’ll explain the basics in simple terms, show you proven strategies used by experienced traders, help you open your first trading account, and give you tips to minimize risk. Whether you’re looking to generate income or hedge your investments, options trading offers opportunities you can’t find in stocks alone. By the time you finish reading, you’ll learn options trading and have the knowledge and confidence to place your first options. Let’s get started!

What Is Options Trading?

Options trading means you’re buying or selling options contracts on the stock market. An options contract gives you the right, but not the obligation, to buy or sell a stock at a specific price within a certain time period.

For example, say you buy a call option contract for stock XYZ with a strike price of $50 and an expiration date 3 months from now. This gives you the right to buy 100 shares of XYZ at $50 per share anytime in the next 3 months, no matter what the actual stock price is. If XYZ stock rises to $60 in that time, you can exercise your call option to buy at $50 and immediately sell at $60, pocketing the difference.

Options trading allows you to control 100 shares of a stock for a fraction of the cost. You can use options to speculate, hedge your risks, or generate extra income. The key is to understand how options work and the potential risks and rewards.

Start by learning the basics: calls vs. puts, strike prices, expiration dates, exercising vs. trading options contracts. Then paper trade to gain experience before using real money. Options trading does involve risks, so only invest money that you can afford to lose. But when done right, options trading can be very lucrative. The opportunities are endless!

An Introduction to Options and How They Work

When you trade options, you’re buying or selling contracts that give you the right – but not the obligation – to buy or sell shares of the underlying security at a specific price within a certain time period.

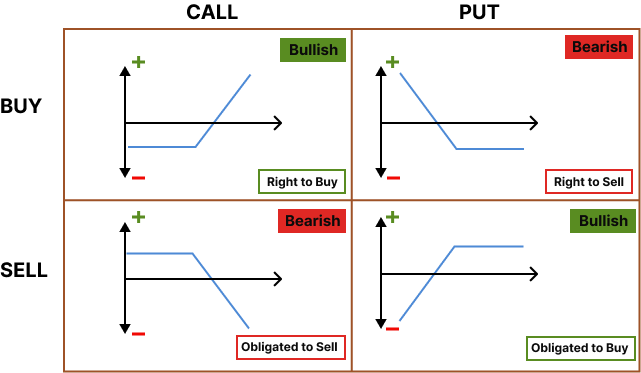

Calls and Puts

The two types of options are calls and puts. A call option gives you the right to buy the underlying stock at a specific price, called the strike price before the option expires. If the stock price goes up, the value of your call option will increase. A put option gives you the right to sell the underlying stock at the strike price before expiration. If the stock price goes down, the value of your put option will increase.

Strike Price and Expiration Date

When you buy an option, you choose a strike price and expiration date. The strike price is the price at which you can buy or sell the underlying stock. The expiration date determines how long you have to exercise your option. Options typically expire monthly, so you’ll choose either weekly, monthly or longer-dated options depending on your strategy.

The key to options trading is understanding how options work and the risks involved. Start by learning the basics, then paper trade to gain experience before risking real money. With practice, you’ll be trading options in no time!

Options Trading Strategies for Beginners – The Basics of Calls, Puts, Spreads and More

The most common options trading strategies for beginners focus on buying and selling call and put options. These options give you the right to buy or sell an underlying stock at a specific price within a certain time period.

Calls

A call option gives you the right to buy 100 shares of a stock at a predetermined price, called the strike price, before the expiration date. You can profit from a call option if the stock price rises above the strike price. This allows you to buy the stock at a discount and sell it at the current market price.

Puts

A put option gives you the right to sell 100 shares of a stock at the strike price before expiration. You can profit from a put option if the stock price falls below the strike price, allowing you to sell the stock at the strike price and buy it back at the lower market price.

Spreads

Option spreads involve combining multiple call and put options with different strike prices. The most common are bull call spreads, bear put spreads, strangles and straddles. Spreads can provide limited risk and higher potential returns than simply buying calls or puts alone. They do cap your maximum profit potential in exchange for reduced risk.

With the basics covered, you now have the foundation to get started with simple call and put buying strategies. Be sure to start with a demo account to practice before using real money. Do thorough research, have clear entry and exit rules, and never risk more than you can afford to lose. Options trading can be very rewarding when done responsibly!

How to Start Trading Options in India – Account Setup, Platforms, Tools and Tips

To start trading options in India, you need to set up an account with a broker that offers options trading. The top brokers for options trading in India are:

Zerodha

It is India’s largest broker and offers options trading on NSE and BSE. Zerodha has competitive brokerage rates and a simple account opening process. You can open an account on their website or mobile app.

Upstox

Upstox is a popular low-cost broker that provides options trading facilities. They offer options on NSE and have an easy-to-use web and mobile platform. Account opening can be done on their website or app.

Once your account is set up, you need to familiarize yourself with the trading platforms and tools. Most brokers offer web, desktop, and mobile platforms to trade options. You should explore the available options chains, Greek calculators, and analysis tools to help determine optimal options strategies.

Some tips for getting started:

- Start with basic calls and put options to understand how they work. Then explore spreads and other strategies.

- Use virtual trading to practice before using real money.

- Keep transaction costs and taxes in mind when planning your options trades. Brokerage and STT can add up quickly.

- Do thorough research on the underlying stock before buying or selling options. Know its volatility, price range, events, etc.

- Start with a small amount of capital and learn through experience. Don’t take on too much risk initially.

- Stay up to date with options for education. The options market is complex so continuous learning is key.

With the right broker, tools, and knowledge, you can become a successful options trader in India. Take your time to learn the basics, use virtual trading, start small, and keep educating yourself.

Conclusion

So there you have it, a complete guide to get you started with options trading in India. Now you know the basics, how options work, the strategies to use, and how to open your first options trading account. If you want to learn more professionally, trading institutes like Traderz Arena can be helpful. The key is to start small, learn the ropes, and practice your strategies without risking too much capital. Options trading can be rewarding but also risky, so do your research, understand the markets, and make informed decisions. Once you get the hang of it, a whole new world of trading opportunities can open up for you. Take the first step and get into the options trading game you’ll be glad you did. The markets are waiting, so go empower yourself as an options trader today!